Investments

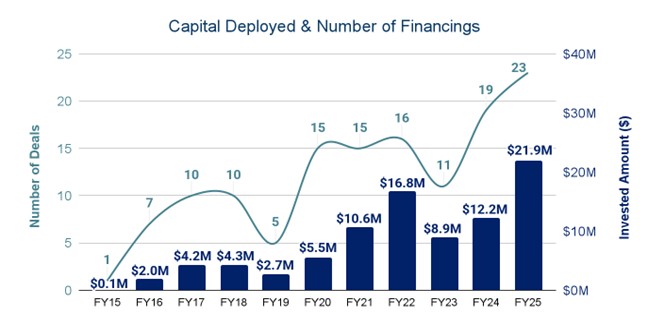

Duke Capital Partners has invested over $89M since our inception in 2015. Of that, $43M came in the last three years.

Early Support

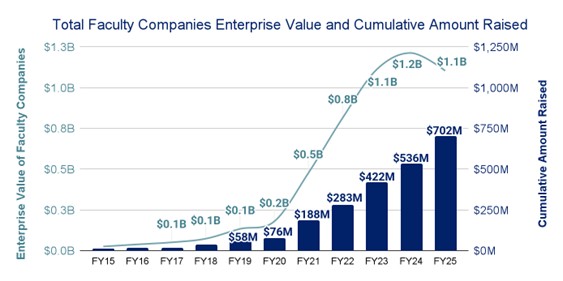

Duke Capital Partners has invested $32.3M into 17 Duke faculty startups, including 9 investments in FY25 and all three FY25 Duke University spin-outs that raised capital.

In FY23, Duke Capital Partners launched the Catalyst Program to increase investments in pre-seed and seed stage companies. Since the launch of Catalyst, DCP has invested more than $4M into 11 companies, with an average step-up valuation of 2.8x in just 2 years.

Portfolio Performance

Duke Capital Partners portfolio companies have raised more than $19.3B and surpassed $90.7B in total enterprise value.

For the fourth consecutive year, three portfolio companies are among the 5000 fastest-growing private companies in America.

DCP outperformed the overall US macro venture capital market by 124.1% in terms of deal count and 82.3% in invested capital between FY23-25.

The US venture market has pulled back sharply since its 2021 peak, yet DCP made four of its six largest investments during this downturn as the market still recovers.

Company Exits

Duke Capital Partners has had 11 total portfolio company exits, including a record 4 exits in FY25, including Hinge Health (IPO), Carpe (acquisition), and two confidential transactions.

Students Trained

Duke Capital Partners had 42 Student Associates in FY25, the largest cohort since our inception, hailing from a variety of Duke schools and departments. In the last 7 years, the DCP Associate Program has grown tenfold and has a 10% acceptance rate.

Over 50% of the FY25 Associates class identifies as female or minority.