Our Mission

We leverage the power of the global Duke community to invest in and support entrepreneurs, to educate and empower students, and to engage and activate our members' contributions to the University's innovation ecosystem.

Entrepreneurs

We provide funding, mentorship, and support for select entrepreneurs with a Duke connection.

Students

We train Duke students on all aspects of the investing process with hands-on experience.

Investors

We facilitate early-stage investment and growth opportunities for investors with a Duke connection.

Organization and Process

Duke Capital Partners is led by its Managing Director and a professional Operating Team. Our members are world-class experts from the global Duke entrepreneurial community. They are committed to helping portfolio founders and their companies reach their full potential. The Operating Team has extensive experience in fund management, diligence, and investor relations, and oversees the operations of both Duke Capital Partners and the Duke Innovation Fund. A team of student Associates learn about venture capital, startups, and assist with sourcing, screening, and diligence.

Coinvestors

A Dedicated Team

With more than 75 years of experience, our professional Operating Team leads Duke Capital Partners' investment process and educates the next generation of investment professionals and startup founders through our Associate program.

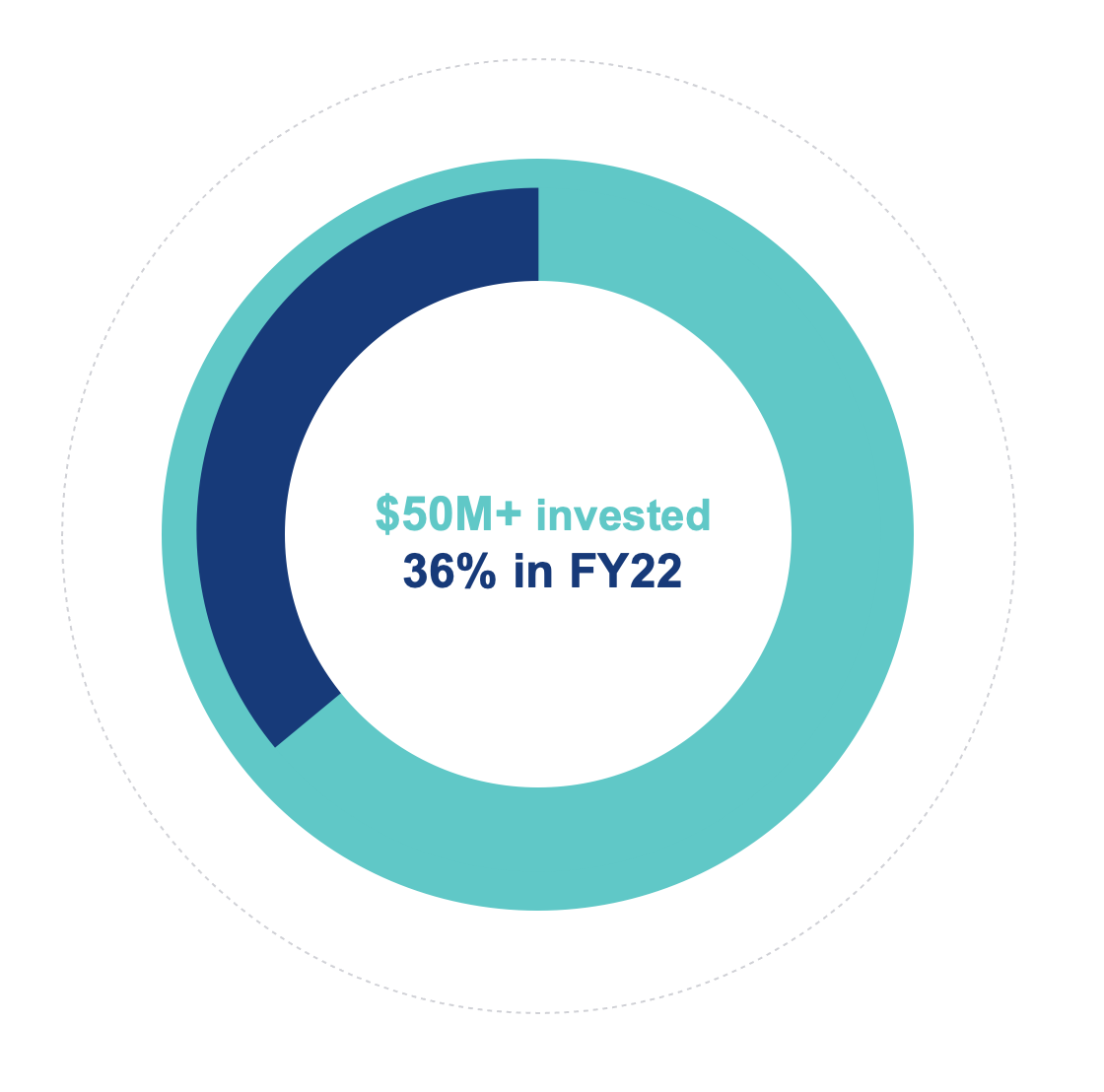

Contribute to Duke Capital Partners

Duke Capital Partners gratefully accepts gifts in support of our mission to strengthen the university’s entrepreneurial ecosystem.